Delta, British Columbia, August 28, 2019. Desert Gold Ventures Inc. (“Desert Gold” or “the Company”)(TSX.V: DAU, FF: QXR2, OTC: DAUGF) is pleased to announce that the Company has entered into an agreement (the “Agreement”) with AIM and TSX.V co-listed Altus Strategies PLC (“Altus”), to acquire Altus’ Sebessounkoto Sud and Djelimangara gold projects (“Project”) which are contiguous to the Company’s Senegal Mali Shear Zone Project located in western Mali.

About the Altus Properties

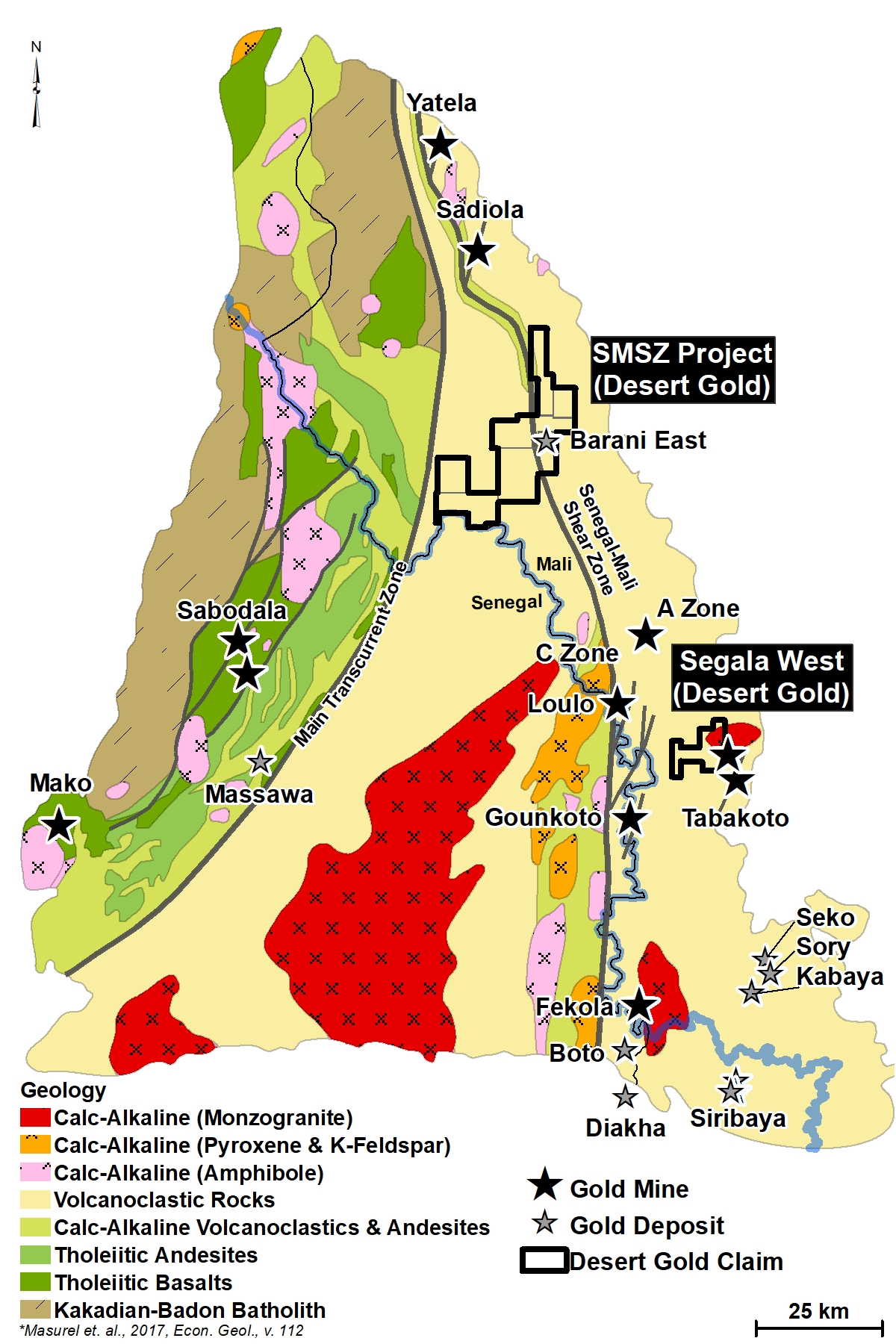

Desert Gold’s acquisition of Altus’ two concessions, along, and just east, of the Senegal Mali Shear Zone (SMSZ), increases the size of Desert Gold’s contiguous land package, by a further 28% to 379.9 km2 (see Figure 2). Furthermore, the addition of the Altus ground, doubles Desert Gold’s holdings along strike, and east of the SMSZ, from 17 to 34 kilometres. This is material since the SMSZ is related to multi-million-ounce gold mines and deposits owned by Barrick (Loulo, Gounkoto, Massawa), B2Gold (Fekola), Anglogold Ashanti/Iamgold (Sadiola, Yatela) and Iamgold (Boto, Diahka), that are located, along strike, both to the north and south (see Figure 1). The addition of this property further cements Desert Gold’s strategic land package along some of the most prospective ground in West Africa.

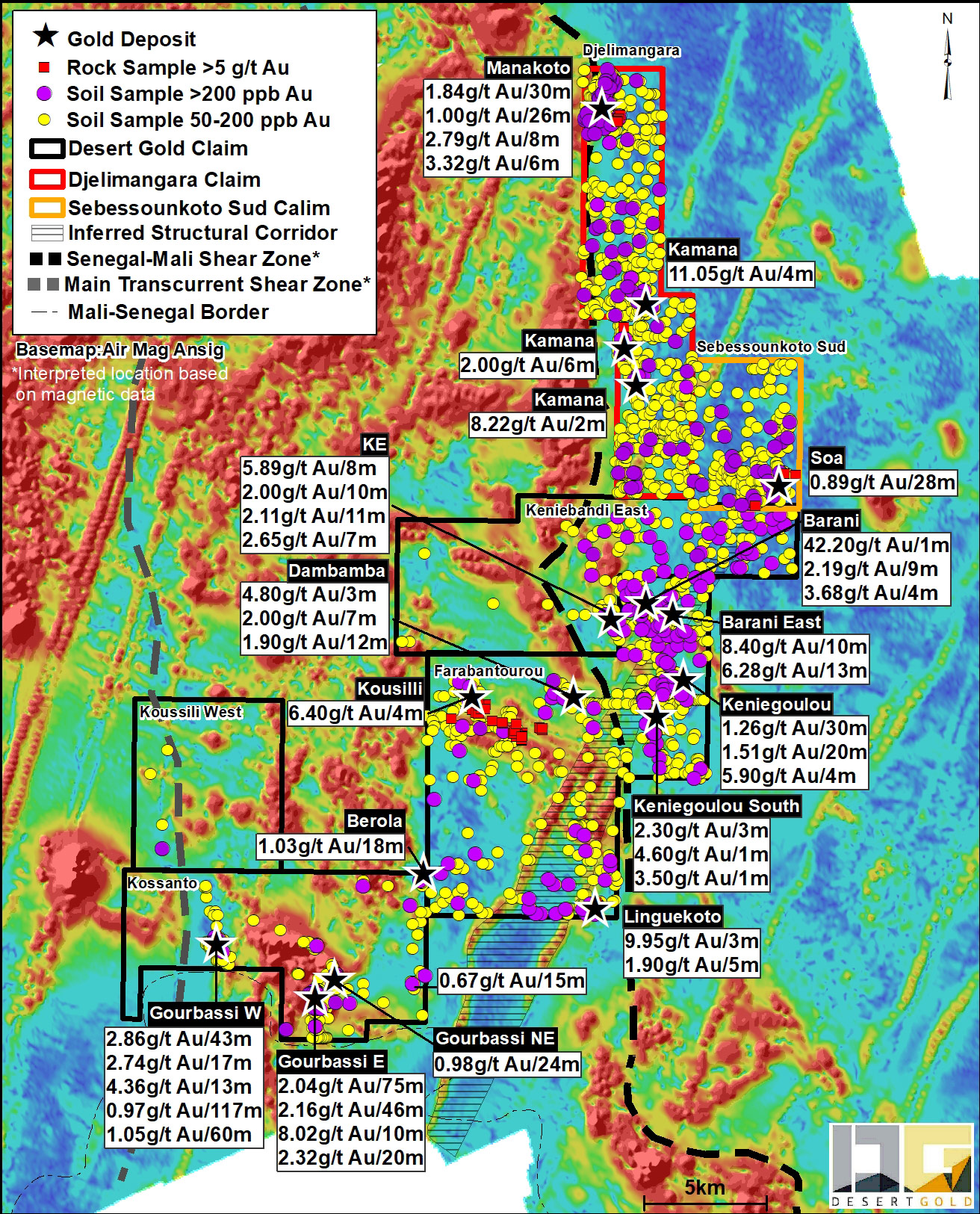

Previous work on the Altus ground discovered five gold mineralized zones (see Figure 2) with drill intercepts to 1.84 g/t gold over 30 metres (Manakoto Prospect) and trenching returning up to 0.89g/t gold over 28 metres (Soa Prospect). In addition to following up on previous drill and trench results, Desert Gold will review and drill test if warranted, the myriad of both moderate to strong gold-in-soil anomalies. As well, the Altus ground hosts the northeast strike extension of the structural corridor which hosts Desert Gold’s Barani East, Linguekoto and several newly discovered artisanal mining zones; the undrilled Soa Prospect lies along this trend.

Figure 1 – Project Location and Regional Geology

Figure 2 – Desert Gold’s SMSZ Project – Significant Results

Summary Terms

Desert Gold will earn a 100% interest in the Project by satisfying the following headline terms:

Part 1: Consideration

- Upon signing of the Agreements by the Parties, Desert Gold will:

- Within 5 business days make a cash payment to Altus of USD $50,000; and

- Within 14 business days and subject to any regulatory approval as may be required, issue 3,000,000 common shares of Desert Gold to Altus.

Part 2: Milestone payments

- Upon the reception of a NI 43-101 compliant independent resource over the Project, which exceeds 500,000 ounces of gold, Desert Gold will (in respect of the first 500,000 ounces only):

- Within 5 business days make a cash payment to Altus of US$100,000; and

- Within 14 business days and subject to any regulatory or shareholder approvals as may be required, issue 2,000,000 common shares of Desert Gold to Altus.

- Upon the reception of a NI 43-101 compliant independent resource over the Project which exceeds 1,000,000 ounces of gold then Desert Gold will (in respect of the second 500,000 ounces only):

- Within 5 business days make a cash payment to Altus of US$100,000; and

- Within 14 business days and subject to any regulatory or shareholder approvals as may be required, issue 3,000,000 shares of Desert Gold to Altus.

Part 3: Project Royalties

- Altus will retain a 2.5% Net Smelter Return (“Altus NSR”) royalty on the Project.

- Desert Gold will have the right to repurchase up to 1.5% of the Altus NSR. The amount payable by Desert Gold to Altus will be calculated by reference to the NI 43-101 gold reserve figure reported in an independent definitive feasibility study on the Project as follows:

- If the reserve is greater than 1,000,000 ounces, then US$6.0M

- If the reserve is less than 1,000,000 ounces but greater than 500,000 ounces, then US$3.0M

- If the reserve is less than 500,000 ounces but greater than 250,000 ounces, then US$1.0M

- Furthermore, Desert Gold will have a 60 day right of first refusal, to acquire such portion of the balance of the Altus NSR that Altus may, from time to time, wish to sell.

- Lastly, Altus will provide Desert Gold a 10-day written notice of any intention to sell any of its Desert Gold shares. During that 10-day period, Desert Gold will have the right to find a third party to acquire such Desert Gold shares directly from Altus.

--

Jared Scharf, Desert Gold’s President, states, “this deal with Altus fits Desert Gold’s regional strategy of accumulating property proximal to the Senegal Mali Shear Zone, a structure that is related to some of the best gold deposits in West Africa and perhaps the world. During the next few months, we will be developing our Q4, 2019/2020 exploration program. We anticipate carrying out a robust drill program with a focus on those targets, which we believe can host material-size, gold deposits.” Mr. Scharf, also added “we welcome Altus as a significant shareholder and appreciate their willingness to sell a 100% interest in the Project, which aligns both of our corporate interests.”

This press release contains certain scientific and technical information. The Company is solely responsible for the contents and accuracy of any scientific and technical information related to it. Don Dudek, P.Geo a director of Desert Gold and a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information contained in this press release.

--

ON BEHALF OF THE BOARD

“Sonny Janda”

____________________

Sonny Janda, Director

Contact:

Jared Scharf, President and Director

Email:

Tel. No.: +1 (858) 247-8195

For further information please visit our website www.desertgold.ca or information available on www.SEDAR.com under the company’s profile.

Certain statements contained in this release may constitute "forward–looking statements" or "forward-looking information" (collectively "forward-looking information") as those terms are used in the Private Securities Litigation Reform Act of 1995 and similar Canadian laws. These statements relate to future events or future performance. The use of any of the words “could”, “intend”, “expect”, “believe”, “will”, “projected”, “estimated”, “anticipates” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company’s current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to the business of the Company, the Property, financing and certain corporate changes. The forward-looking information contained in this release is made as of the date hereof and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein in the united states. The securities described herein have not been and will not be registered under the united states securities act of 1933, as amended, and may not be offered or sold in the united states or to the account or benefit of a U.S. person absent an exemption from the registration requirements of such act.