Delta, British Columbia, May 23, 2019. Desert Gold Ventures Inc. (“Desert Gold” or “the Company”) (TSX.V: DAU, FF: QXR2, OTC: DAUGF) announces that, subject to exchange approval, it will conduct a non-brokered private placement of up to 15,625,000 units at a price of CDN $0.16 per unit (the “Unit”) to raise up to an aggregate of up to CDN $2,500,000 (the “Financing”). Each Unit will consist of one common share in the equity of the Company and one common share purchase warrant (the “Warrant”). Each Warrant entitles the holder to purchase one additional common share of the Company at a price of CDN $0.24 per common share for a period of two (2) years from the closing of the Financing.

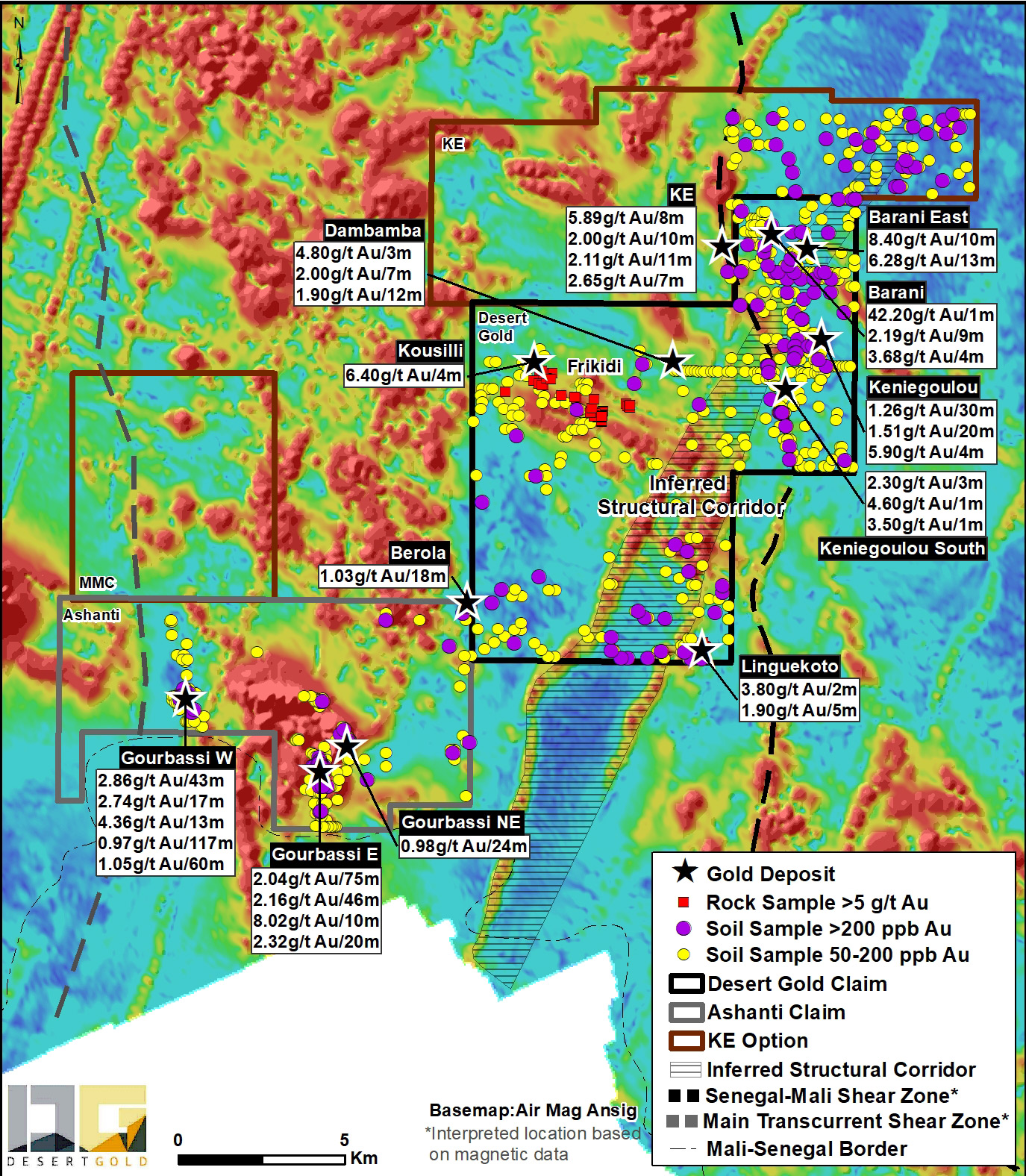

The proceeds of the Financing will be used primarily for drilling, property acquisition, and other exploration work at the Company’s flagship Senegal Mali Shear Zone Project (the “SMSZ Project”) in Western Mali (see Figure 1) and for general working capital purposes. The Company may pay a finder’s fee to qualified finders in respect to the Financing. Securities issued as a result of the Financing will be subject to a statutory hold period.

SMSZ Project priority drill targets include:

- Barani East to follow-up on an intercept of 6.3 g/t gold over 13 meters OPEN down plunge;

- KE zone to follow up on several intercepts highlighted by 5.89 g/t gold over 8 meters;

- The Frikidi area where more than three mineralized trends, with multiple grab samples returning values of greater than 100 g/t gold;

- An inferred structural intersection zone of three known mineralized trends and;

- Targets generated by field staff during the last few months of mapping and prospecting.

As well, upon closing of the Ashanti Gold acquisition, a substantial effort will be directed towards modeling the significant amount of mineralization that has been discovered at the Gourbassi East and West zones and surrounding area. Highlighted drilling from the Gourbassi East and West zones include; 2.86 g/t gold over 43 meters, 4.36 g/t gold over 13 meters, 2.04 g/t gold over 75 meters and 8.02 g/t gold over 10 meters(1).

QA/QC Procedures

All grab samples were geologically described following Desert Gold’s established standard operating procedures. For grab sampling, all individual samples represent approximately 2-3 kilograms that is sent for preparation and gold assaying at the SGS laboratories in Bamako, Mali. Each sample is fire-assayed for gold by SGS laboratories in Bamako using Au-FAA505 method that is a 50g fire assay fusion with AAS instrument finish. In addition to SGS own QA/QC (Quality Assurance/Quality Control) program, an internal quality control and quality assurance program is in place throughout the sampling program, using blind duplicates (1:20), blanks (1:20) and recognized industry standards (1:20).

- Estimated true widths range from 60% to 95% of drilled width

- Grab samples are selective samples and are not necessarily representative of the mineralisation hosted on the property

Don Dudek, P.Geo. is a director of Desert Gold and a Qualified Person under National Instrument 43-101, has reviewed and approved the Desert Gold scientific and technical information contained in this press release

ON BEHALF OF THE BOARD

“Jared Scharf”

___________________________

Jared Scharf

President & Director

About Desert Gold

Desert Gold Ventures Inc. is a gold exploration and development company which holds 3 gold exploration permits in Western Mali (Farabantourou, Segala West and Djimbala) and its Rutare gold project in central Rwanda. For further information please visit www.SEDAR.com under the company’s profile. Website: www.desertgold.ca

Contact

Jared Scharf, President and Director

Email:

Tel. No.: +1 (858) 247-8195

This news release contains forward-looking statements respecting the Company's ability to successfully complete the Offering. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements, including the inability of the Company to successfully complete the Offering. These uncertainties and risks include, but are not limited to, the strength of the capital markets, the price of gold; operational, funding, and liquidity risks; the degree to which mineral resource estimates are reflective of actual mineral resources; and the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with mining operations. Risks and uncertainties about the Company's business are more fully discussed in the company's disclosure materials filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. The Company assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein in the United States. The securities described herein have not been and will not be registered under the united states securities act of 1933, as amended, and may not be offered or sold in the united states or to the account or benefit of a U.S. person absent an exemption from the registration requirements of such act.