Delta, British Columbia, May 7, 2019. Desert Gold Ventures Inc. (“Desert Gold” or “the Company”)(TSX.V: DAU, FF: QXR2, OTC: DAUGF) is pleased to announce that the Company has entered into an option agreement with Mineral Management Consulting (“MMC”) to acquire a 100% interest in two properties contiguous and proximal to the Company’s flagship Farabantourou gold project in Western Mali. MMC is a private company located in Bamako, Mali, involved in the acquisition and exploration of mineral properties. The MMC property acquisition is another step in Desert’s Gold’s regional strategic plan (see Figure 1).

About the MMC Properties

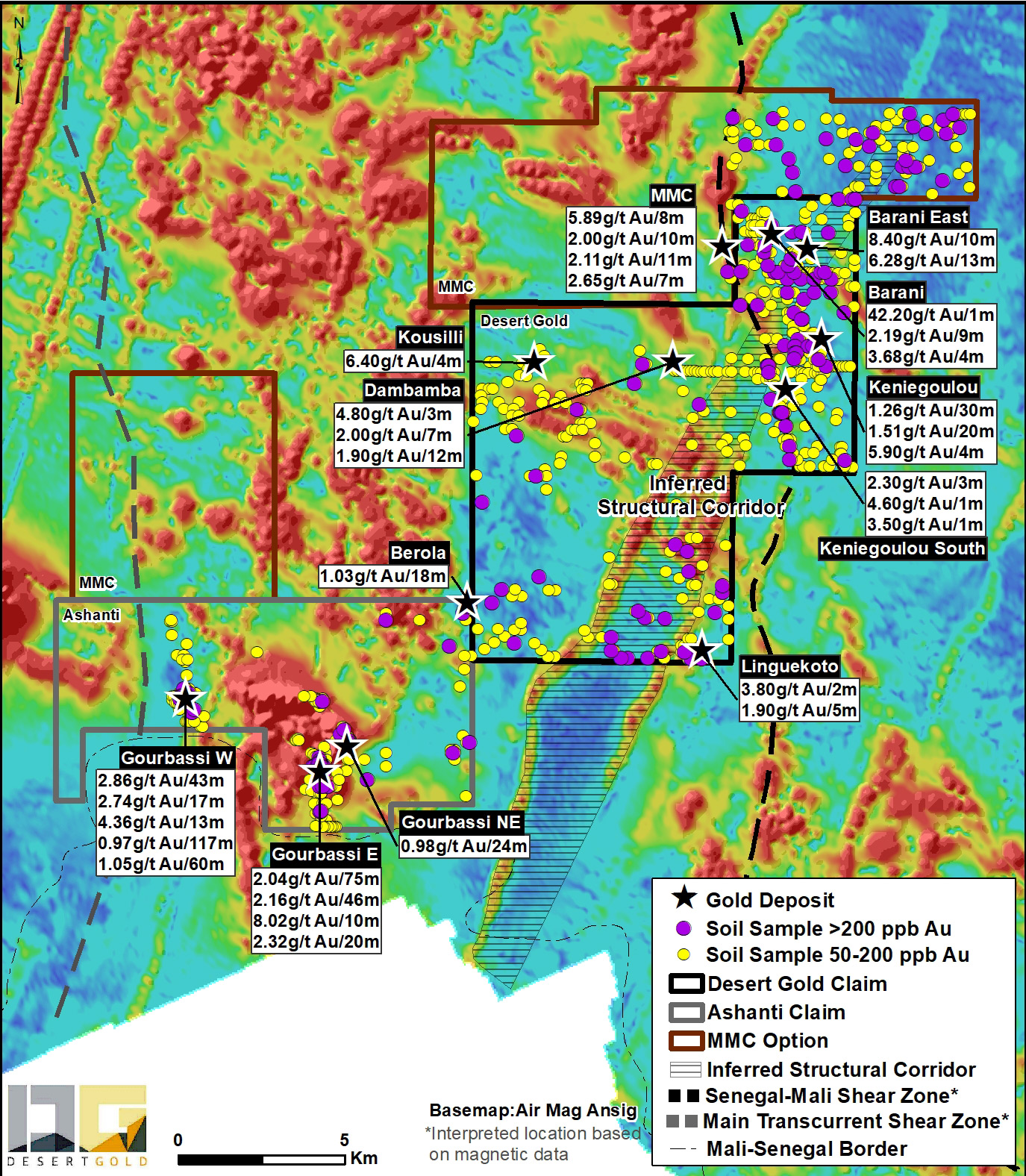

The first concession, Keniebandi East, is 60km2 in size and is contiguous to the northern border of the Company’s Farabantourou property. A brief summary of the concession follows:

- Keniebandi East encompasses an additional 3.5 km portion of the Senegal Mali Shear Zone (“SMSZ”)

- Upon completion of this acquisition Desert Gold would control exploration ground along 11 km of the SMSZ, which, regionally, is related to 6 gold deposits, 5 of which exceed 3 million ounces(1)

- The concession contains a partially tested 440-metre long, open-ended gold zone with historic drill values to 5.89 g/t gold over 8 metres

- The permit also contains an additional 26, untested, >200 ppb gold-in-soil anomalies, a group of which lies along a previously highlighted northeast-trending structural corridor, which hosts the Companies’ Barani East gold deposit.

The second MMC concession, Koussili West, is 43km2 in size and lies immediately north, along strike, of Ashanti Gold’s Gourbassi West Zone (Ashanti Gold is subject to an acquisition proposal by Desert Gold previously announced on April 1, 2019). The Gourbassi West Zone lies proximal to the interpreted location of the Main Transcurrent Fault, which is related to Barrick’s 3-million ounce Massawa gold deposit(2). Even though Koussili West lies along a highly prospective trend, there is no previous recorded exploration. For reference, the Gourbassi West Zone has returned drill intercepts to 2.86 g/t gold over 43 metres. Mineralization hosted on adjacent properties is not necessarily indicative of mineralization that may be identified on the MMC properties.

Both MMC properties have seen little to no previous exploration with 60% to 100% of the properties not even covered by soil sampling. Based on previous Desert Gold experience, with the recent discovery of numerous gold zones on its Farabantourou property, management strongly believes the systematic exploration of these new properties will lead to the discovery of new gold zones.

Figure 1. Regional image of Farabantourou, Ashanti Gold concessions and new MMC properties

Key Terms of the Option Agreement

- Desert Gold to pay MMC CAD $500,000, of which CAD $250,000 will be paid upon closing of the transaction to earn an initial fifty-five (55%) percent interest with the balance of CAD $250,000 to be paid over a three (3) year period;

- The issuance of 1,000,000 Desert Gold common shares to MMC in four (4) equal instalments of which 250,000 shares will be issued upon closing of the transaction and the remaining instalments are to be issued annually over a three (3) year period;

- Incur exploration expenditures of CAD $350,000 over a three (3) year period;

- MMC shall retain a two (2%) percent net smelter royalty on all ore mined from the properties;

- During the three (3) year option period, Desert Gold shall be responsible for maintaining the permit in good standing and performing any and all obligations required by law and will take over operation control of the projects on closing of the transaction with MMC

Desert Gold’s President remarks, “The acquisition of the MMC properties on commercially viable terms is consistent with our strategy of creating a regionally significant land package on one of the most desirable geological structures in all of Africa.”

About the Ashanti Gold Acquisition

On April 1, 2019 the Company announced that it had entered into a definitive agreement to acquire Ashanti Gold Corp by way of a 3-cornered amalgamation. The amalgamation is subject to a May 13, 2019, Ashanti shareholder vote and the renewal of Ashanti’s Kossanto East permit in Western Mali.

ON BEHALF OF THE BOARD

“Sonny Janda”

___________________________

Sonny Janda

CEO & Director

About Desert Gold

Desert Gold Ventures Inc. is a gold exploration and development company which holds 3 gold exploration permits in Western Mali (Farabantourou, Segala West and Djimbala) and its Rutare gold project in central Rwanda. For further information please visit www.SEDAR.com under the company’s profile. Website: www.desertgold.ca

Contact:

Jared Scharf, President and Director

Email:

Tel. No.: +1 (858) 247-8195

Don Dudek, P.Geo. is a director of Desert Gold and a Qualified Person under National Instrument 43-101, has reviewed and approved the Desert Gold scientific and technical information contained in this press release.

- Barrick’s Loulo-Gounkoto mine complex to the west with ore reserves of 32 Mt (million tonnes) average at 4.6 g.t for 3.7 million oz Au in the Proven and Probable category. BCM’s (formerly Endeavour Mining) Tabakoto and Segala mines which hosts ~3 million oz Au (18.5 Mt at 3.5 g/t for 1.8 million oz Au Measured and Indicated, 9 Mt at 3.6 g/t for 1 million oz Au Inferred and 6.4 Mt at 3.5 g/t for 0.7 million oz Au Proven and Probable. B2Gold Fekola mine to the south with ore reserves of 48.3 Mt average at 2.37 g/t gold for 3.34 million oz Au in the Proven and Probably category and 65.8 Mt average at 2.13 g/t gold for 4.5 million oz Au. To the north Sadiola/Yatela mine contains ore reserves of 38 Mt at 1.57 g/t gold for 2 million oz Au and 87 Mt at 1.58 g/t gold for 6 million oz Au in the Measured and Indicated category. Source: company annual reports and corporate filings.

- Barrick website - https://barrick.q4cdn.com/788666289/files/quarterly-report/2018/Randgold-2018-Reserves-Resources.pdf ; Estimated Indicated mineral resources of 23Mt @ 4.0 g/t Au totalling 2.5 million ounces of gold and estimated inferred mineral resources.

This news release contains forward-looking statements respecting the Company's ability to successfully complete the Offering. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements, including the inability of the Company to successfully complete the Offering. These uncertainties and risks include, but are not limited to, the strength of the capital markets, the price of gold; operational, funding, and liquidity risks; the degree to which mineral resource estimates are reflective of actual mineral resources; and the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with mining operations. Risks and uncertainties about the Company's business are more fully discussed in the company's disclosure materials filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. The Company assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law. Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein in the United States. The securities described herein have not been and will not be registered under the united states securities act of 1933, as amended, and may not be offered or sold in the united states or to the account or benefit of a U.S. person absent an exemption from the registration requirements of such act.