Delta, British Columbia, October 18, 2018. Desert Gold Ventures Inc. (“Desert Gold” or “the Company”) (TSXV: DAU) (FF: QXR2) (OTC: DAUGF) is pleased to provide guidance regarding the upcoming work season. The Company is also pleased to announce that during ongoing geological mapping and surficial exploration at its Farabantourou permit, the Company has discovered a new mineralized trend consisting of several active large artisanal mining sites known as the Frikidi trend.

Frikidi Trend Observation

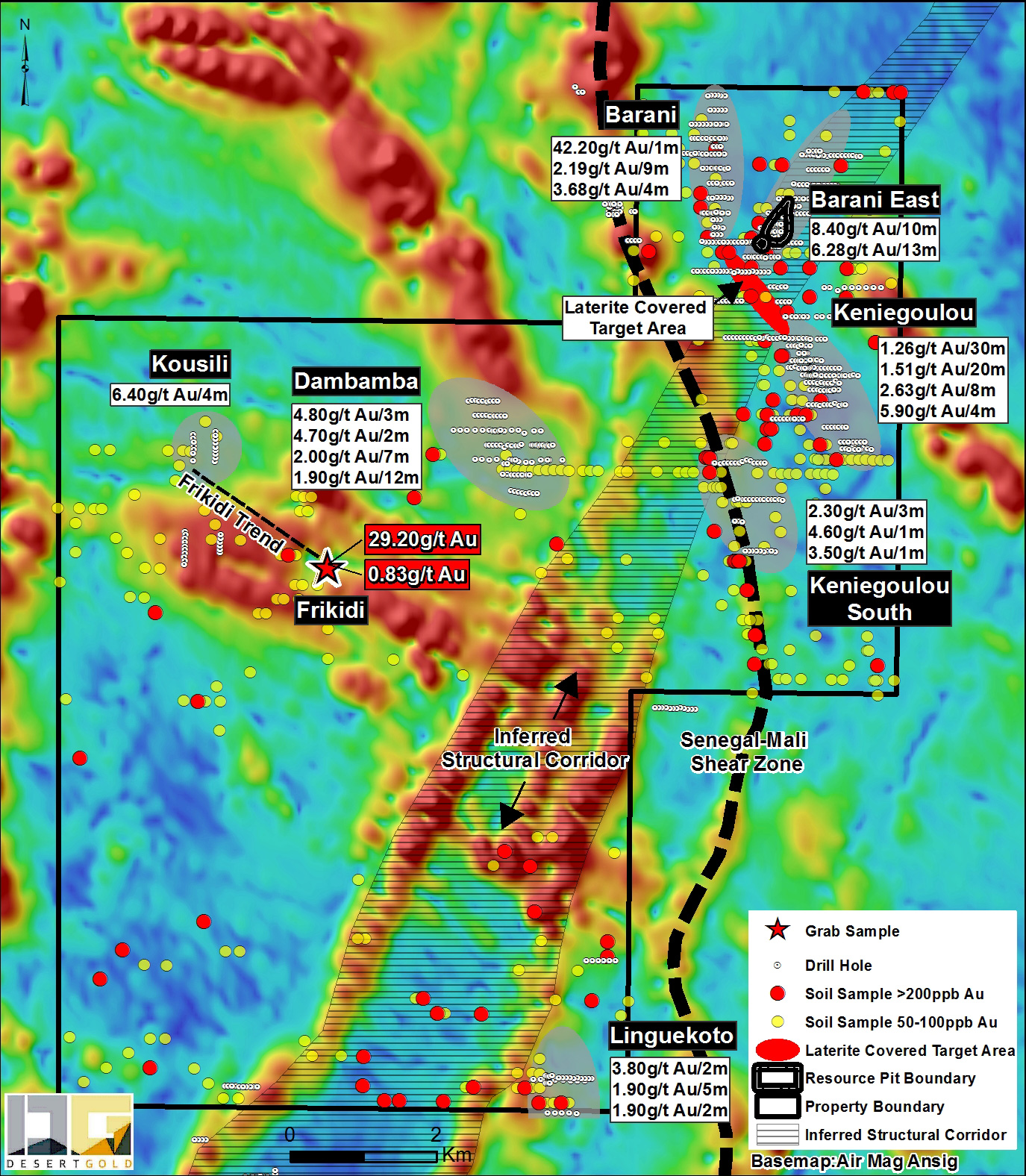

The newly discovered Frikidi trend and related artisanal mining areas are hosted by strong, sericite-, potassic- and pyrite-altered felsic sills that intrude a northwest-trending package of intermediate volcanic rocks along a 2.4 km long, northwest trend. Two grab samples of the zone returned 29.7 g/t Au and 0.83 g/t Au which strongly supports the observed artisanal mining. Proximal ‘waste’ piles up to five metres high are predominantly comprised of strongly altered felsic intrusion and are believed to be gold-bearing. Further geological mapping and additional rock sampling will be conducted on this target later in the year. Grab samples are selected samples that are not necessarily representative of the mineralization hosted on the property.

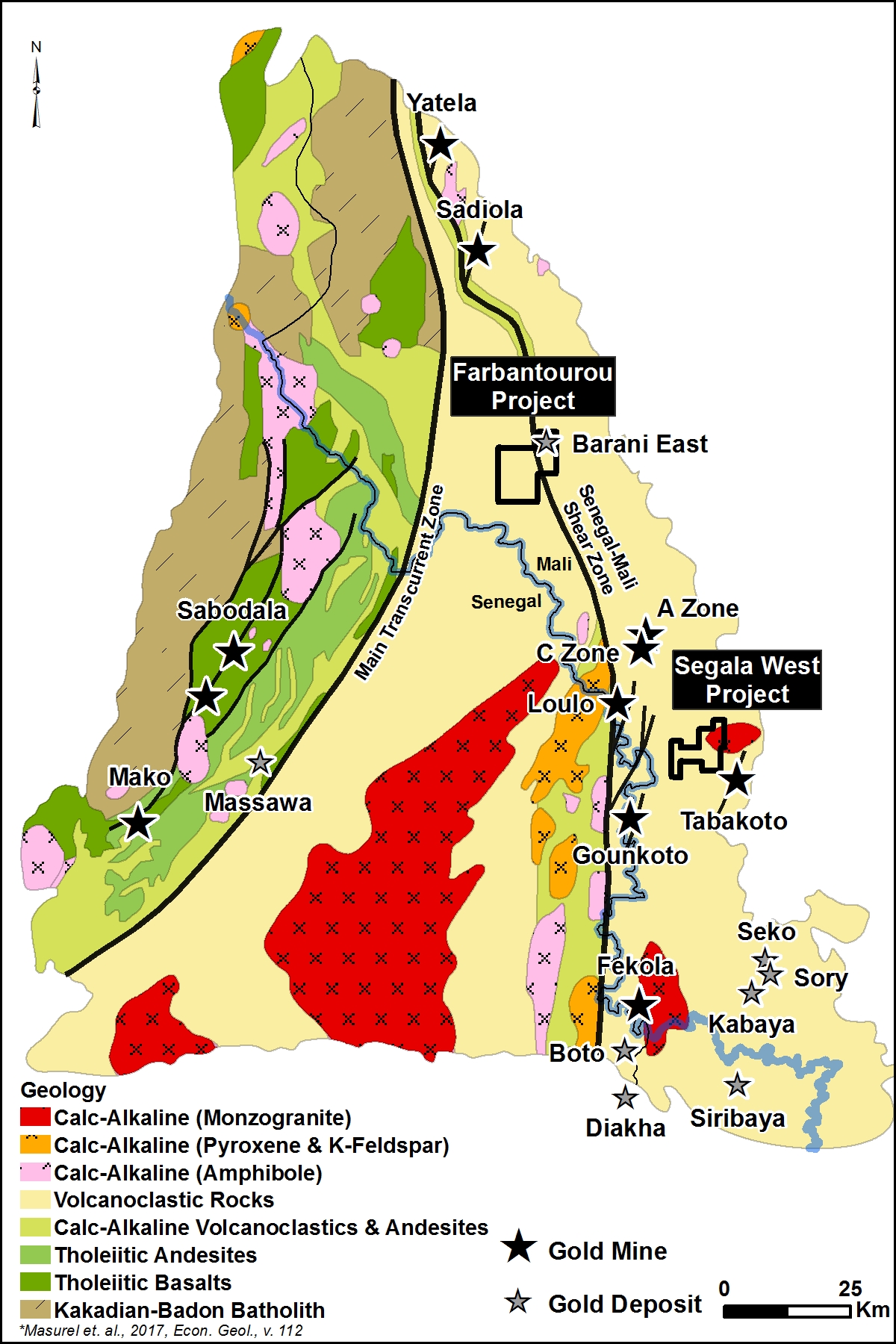

The Frikidi zone host rocks are inferred to be folded equivalents of the Mako Series rocks which host Teranga’s Sabodala Mine, Toro Gold’s Mako Mine and Randgold’s advanced Massawa exploration project, which lie on the western side of the Mali-Senegal Shear Zone. This occurrence area has never been drill tested before and represents additional upside to Desert Gold’s Farabantourou Project (see Figure 1).

Gold-in-soil Follow-up

In addition to a follow-up on historic drill results, property-scale soil sampling demonstrates a significant amount of gold-in-soil anomalies and anomalous gold-in-soil anomaly trends that have not yet been fully evaluated. The newly discovered Frikidi Trend was one of these anomalous areas. Based on the attached figure, there are in excess of 45 untested gold-in-soil anomalies containing greater than 200 ppb gold with values ranging up to 7,589 ppb gold. These anomalies occur both east and west of the Mali-Senegal Shear Zone, suggesting significant exploration potential in a variety of geological settings (see Figure 1).

Work Commencement

Fieldwork in Mali is scheduled to start in early December 2018 shortly after the end of the rainy season and continue into 2019. The company is planning an ambitious exploration program at all three of its properties in Mali. At Farabantourou, drilling is planned to follow-up known gold zones. At Farabantourou and Segala West, auger drilling will be carried out over select laterite-covered zones in conjunction with geological mapping, prospecting and systematic evaluation and prioritization of strong gold-in-soil targets. At Djimbala, which is contiguous to Hummingbird’s Yanfolila mine permit, previously collected soil samples will be analyzed with follow-up field evaluation and property-scale mapping. This work, in conjunction with drilling, is expected to lead to the development of a significant amount of new priority drill targets at all three properties.

Figure 1. Farabantourou Property Map Showing Frikidi Trend and Gold-in-Soil Anomalies

Desert Gold holds three gold projects (Farabantourou, Segala Ouest and Djimbala), of which, Farabantourou and Segala West are located within the Kenieba Inlier of western Mali. The Farabantourou project lies 40 km to the south of AngloGold Ashanti’s/Iamgold’s Sadiola gold mine and 50 km to the north of Randgold’s Loulo-Gounkoto complex gold mines (see Figure 2).

Figure 2. Location of Desert Gold’s Farabantourou and Segala Ouest gold projects in western Mali

- Randgold's Loulo-Gounkoto mine complex to the west with ore reserves of 32 Mt average at 4.6 g.t for 3.7 million oz Au in the Proven and Probably category. Endeavour Mining's Tabakoto and Segala mines which hosts ~3 million oz Au (18.5 Mt at 3.5 g/t for 1.8 million oz Au measured and indicated, 9 Mt at 3.6 g/t for 1 million oz Au inferred and 6.4 Mt at 3.5 g/t for 0.7 million oz Au proven and probable. B2Gold Fekola mine to the south with ore reserves of 48.3 million Mt average at 2.37 g/t gold for 3.34 million oz Au in the Proven and Probably category and 65.8 million Mt average at 2.13 g/t gold for 4.5 million oz Au. To the north Sadiola/Yatela mine contains ore reserves of 38 million Mt at 1.57 g/t gold for 2 million oz Au and 87 million Mt at 1.58 g/t gold for 6 million oz Au in the measured and indicated category.

QAQC

All rock samples were geologically described following Desert Gold’s established standard operating procedures. All individual samples represent approximately 2-kilogram which is sent for preparation and gold assaying at the SGS laboratories in Bamako, Mali. Each sample is fire-assayed for gold by SGS laboratories in Bamako using Au-FAA505 method which is a 50g fire assay fusion with AAS instrument finish. In addition to SGS own QA/QC (Quality Assurance/Quality Control) program, an internal quality control and quality assurance program is in place throughout the sampling program, using blind duplicates (1 :20), blanks (1 :20) and recognized industry standards (1 :20).

ON BEHALF OF THE BOARD

“Sonny Janda”

___________________________

Sonny Janda

Director

For further information please contact Jared Scharf, President, at +1 (858) 247-8195 or visit www.desertgold.ca

This note was reviewed by Dr. Luc Antoine who is a director of the Company and is registered as a Member of the Geological Society of South Africa (MGSSA 967397). He approves the scientific and technical disclosure in the news release and has the necessary experience relevant to the style of mineralization and types of deposits under consideration and to the activity as a Qualified Person as defined in the National Instrument 43-101.

Additional information can also be viewed at www.SEDAR.com under the company’s profile.

This news release contains forward-looking statements respecting the Company's ability to successfully complete the Offering. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements, including the inability of the Company to successfully complete the Offering. These uncertainties and risks include, but are not limited to, the strength of the capital markets, the price of gold; operational, funding, and liquidity risks; the degree to which mineral resource estimates are reflective of actual mineral resources; and the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with mining operations. Risks and uncertainties about the Company's business are more fully discussed in the company's disclosure materials filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. The Company assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein in the United States. The securities described herein have not been and will not be registered under the united states securities act of 1933, as amended, and may not be offered or sold in the united states or to the account or benefit of a U.S. person absent an exemption from the registration requirements of such act.