TORONTO, June 17, 2013 – Desert Gold Ventures Inc. (TSX-V: DAU) (the "Company" or "Desert Gold") is pleased to announce 94% gold recoveries from a comprehensive gold deportment and metallurgical test work study conducted on composite samples from the recently drilled Barani East Gold Deposit (the “Deposit”). The exceptional results warrant the immediate development of a process flow sheet and plant design as part of the Company’s plans to advance to a mining prefeasibility study on the Deposit.

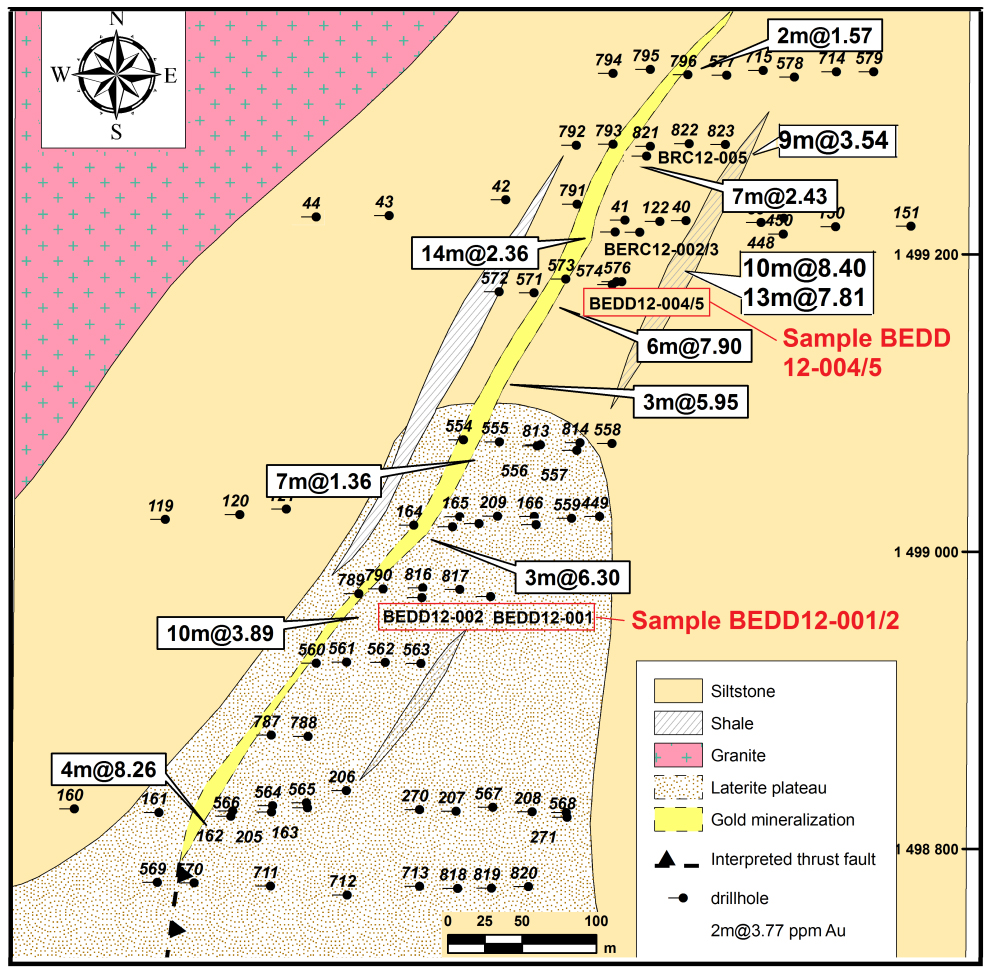

The two gold-bearing composite samples were examined at SGS South Africa (Pty) Ltd in Johannesburg. The samples were taken from boreholes 220m apart to test gold recovery of representative mineralization. The grades of the samples were:

- 2.86g/t Au from two boreholes drilled in the southern part of the deposit and;

- 2.62g/t Au from two boreholes in drilled in the northern part of the deposit.

The study indicated that:

- Direct cyanidation on run of mine material resulted in 94.3% and 94.1 % dissolution of gold after 48 hours for samples BEDD12-004/5 and BEDD12-001/2 respectively.

- Gold in the Barani East deposit is amenable to gravity concentration:

- 46% of the gold in sample BEDD12-004/5 reported in the gravity concentrate at a grade of 114.10 g/t Au

- 43% of the gold in sample BEDD12-001/2 reported in the gravity concentrate at a grade of 157.40 g/t Au

- Intensive leach results on the gravity concentrate at 24 hours retention time shows that 91.9% of the gold in sample BEDD12-004/5 and 98.6% in sample BEDD12-001/2 are made soluble

- The CIL (Carbon in leach) recoveries on the gravity tailings of both samples are high, with BEDD12-004/5 achieving 96% and BEDD12-001/2 achieving 98.6%.

- The presence of deleterious elements such as “preg robbers” was negligible.

About the project:

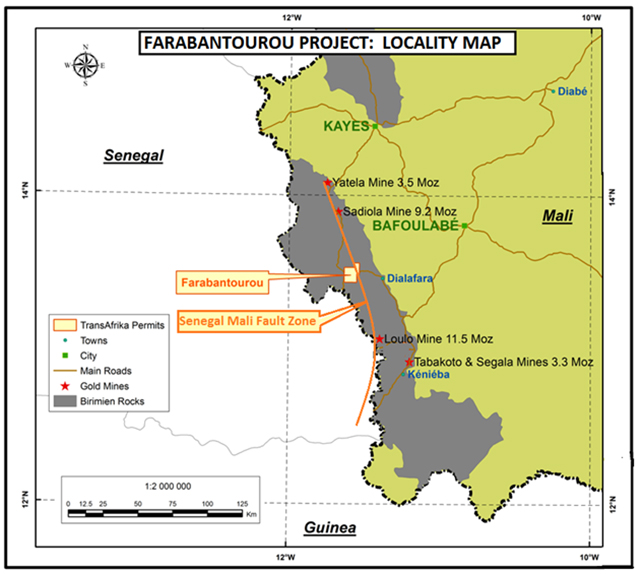

The Barani East Gold Deposit occurs on the Desert Gold’s Farabantourou Permit located in Western Mali. The permit falls on the Senegal-Mali Fault Zone (“SMFZ”), 40km south of Sadiola Mine and 50km north of the Loulou Mine. Both these mines are on the SMFZ.

Barani East is the first of 6 prospects with proven gold mineralization expected to be developed by Desert Gold on the permit. The project was drilled to a depth of 120m and is open to depth in the southern part of the deposit.

Highlights include the following:

- An indicated mineral resource of 514,000 tonnes at 2.46 grams per tonne for 40,600 ounces of gold.

- An inferred mineral resource of 828,000 tonnes at 2.53 grams per tonne for 67,300 ounces of gold.

- The mineral resource lends itself to an opencast mining operation.

- Gold mineralization extends down from surface with high grade intersections made at shallow depths e.g.

- BERC12-002 13m at a gold grade of 7.81g/t from 17m to 30m. Estimated true width 11.5m

- BERC12-003 10m at a gold grade of 8.40g/t from 26m to 36m. Estimated true width 8.8m

- BERC12-005 8m at a gold grade of 3.54g/t from 1m to 9m. Estimated true width 7m

- Continuous gold mineralization over a lateral extend of 400m

Table 1: Barani East Mineral Resource Statement.

| 2013 (April, 05) Tonnes | Grade (g/t) | Gold Ounces | |

| Indicated Mineral Resources | 514,000 | 2.46 | 40,600 |

| Inferred Mineral Resources | 828,000 | 2.53 | 67,500 |

| * Reported at cut-off grade of 1.0 grams of gold per tonne assuming an open pit extraction scenario, a gold price of US$1,300 per ounce, and metallurgical recoveries of 90%. Mineral resources are not mineral reserves and do not have a demonstrated economic viability. | |||

The Barani East indicated mineral resource has been defined to a maximum depth of 120m below surface and over a strike length of 400m. The orientation of the mineralized zone is NNE to SSW with mineralization occurring from surface, dipping SSE at 45o . Gold mineralization is associated with quartz hematite rocks and kaolinite veins. Thickness of the mineralized zone varies with an average thickness of 4.5m and a maximum width of up to 15m. As with these types of deposits, gold grades vary significantly along strike and down dip.

Farabantourou strategy

Desert Gold’s Farabantourou permit strategy is to develop the other 5 gold prospects to a mineral resource definition stage similar to what has been achieved at Barani East. Funding for drilling on the other 5 prospects may well be provided out of mining revenue from a low cost opencast mining operation on Barani East to extract the resource identified from surface to 120m depth. A preliminary feasibility study is underway to define the capex and cost associated with a potential mining operation to extract the resource as defined from surface. High grade Au intersections of 9.99g/t over 4m and 8.60g/t over 3.5m at 120m vertical depth show potential for developing an underground resource at Barani East following the exploitation of the open pit resource.

Geological map and drill plan showing the boreholes sampled for metallurgical test work

Map of western Mali showing the Farabantourou project and major gold mines

The metallurgical results stated in this report have been reviewed by Dario Clemente, registered as a Fellow of the Southern African Institute of Mining and Metallurgy (SAIMM) No 701139 and member of the Mine Metallurgical Managers Association of South Africa (MMMA) No (M000984). He has sufficient experience which is relevant to the style of mineralisation and metallurgical processes under consideration and to the activity which he is undertaking to qualify as a Qualified Person as defined in National Instrument 43-101.

This news release has been prepared on behalf of the board of directors of Desert Gold, which accepts full responsibility for its contents.

About Desert Gold

Desert Gold Ventures Inc. is an advanced exploration and development company which holds mining assets in Mali, Rwanda and Senegal.

This press release includes certain "forward-looking statements". All statements regarding the ability of the Company to successfully complete the Proposed Transaction and the Financing, to successfully integrate the businesses of Desert Gold and TransAfrika and to delineate new resources in proposed drilling programs are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. All statements that are not historical facts, including without limitation statements regarding future estimates, plans, objectives, assumptions or expectations of future performance, are "forwardlooking statements". We caution you that such "forward looking statements" involve known and unknown risks and uncertainties that could cause actual results and future events to differ materially from those anticipated in such statements. Such risks and uncertainties include the inability of the Company to close the Proposed Transaction and the Financing due to the state of the capital markets and other risk factors as discussed in the Company's filings with Canadian securities regulatory agencies. The Company expressly disclaims any obligation to update any forwardlooking statements except as may be required by law.

For further information concerning Desert Gold Ventures Inc. and the TransAfrika material properties, please refer to Desert Gold's SEDAR profile at www.sedar.com or visit our website at www.desertgold.ca, or contact: