Mali

Senegal Mali Shear Zone Project

A Growing Resource Base in a Tier 1 Gold District

-

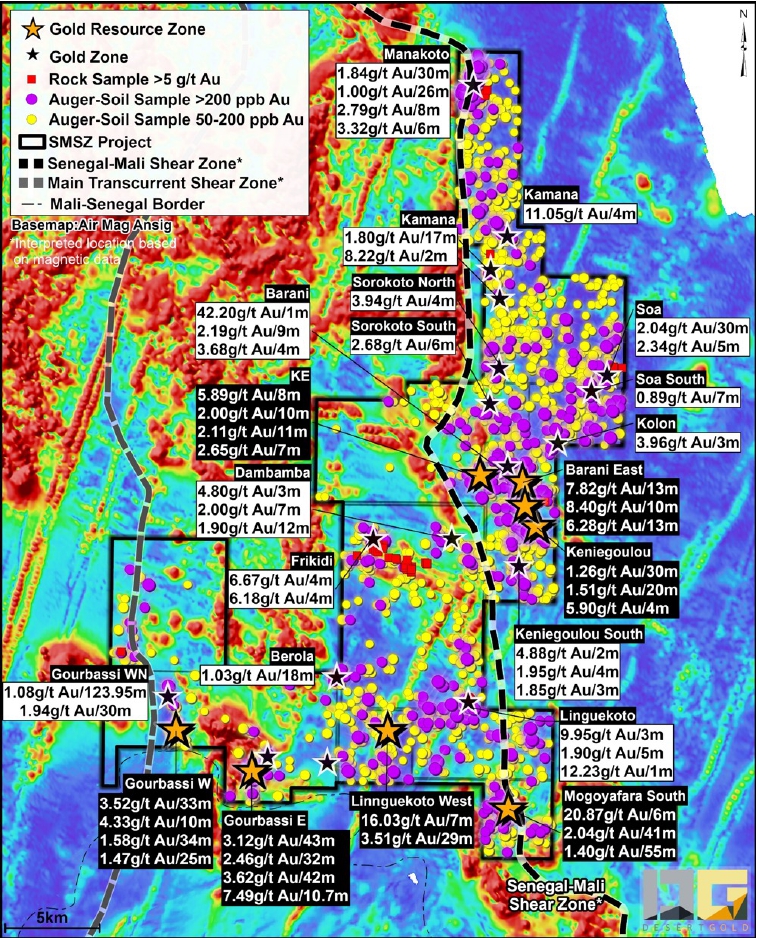

Inferred Mineral Resources of 769,200 ounces of Gold

-

M&I Mineral Resources of 310,300 ounces of Gold

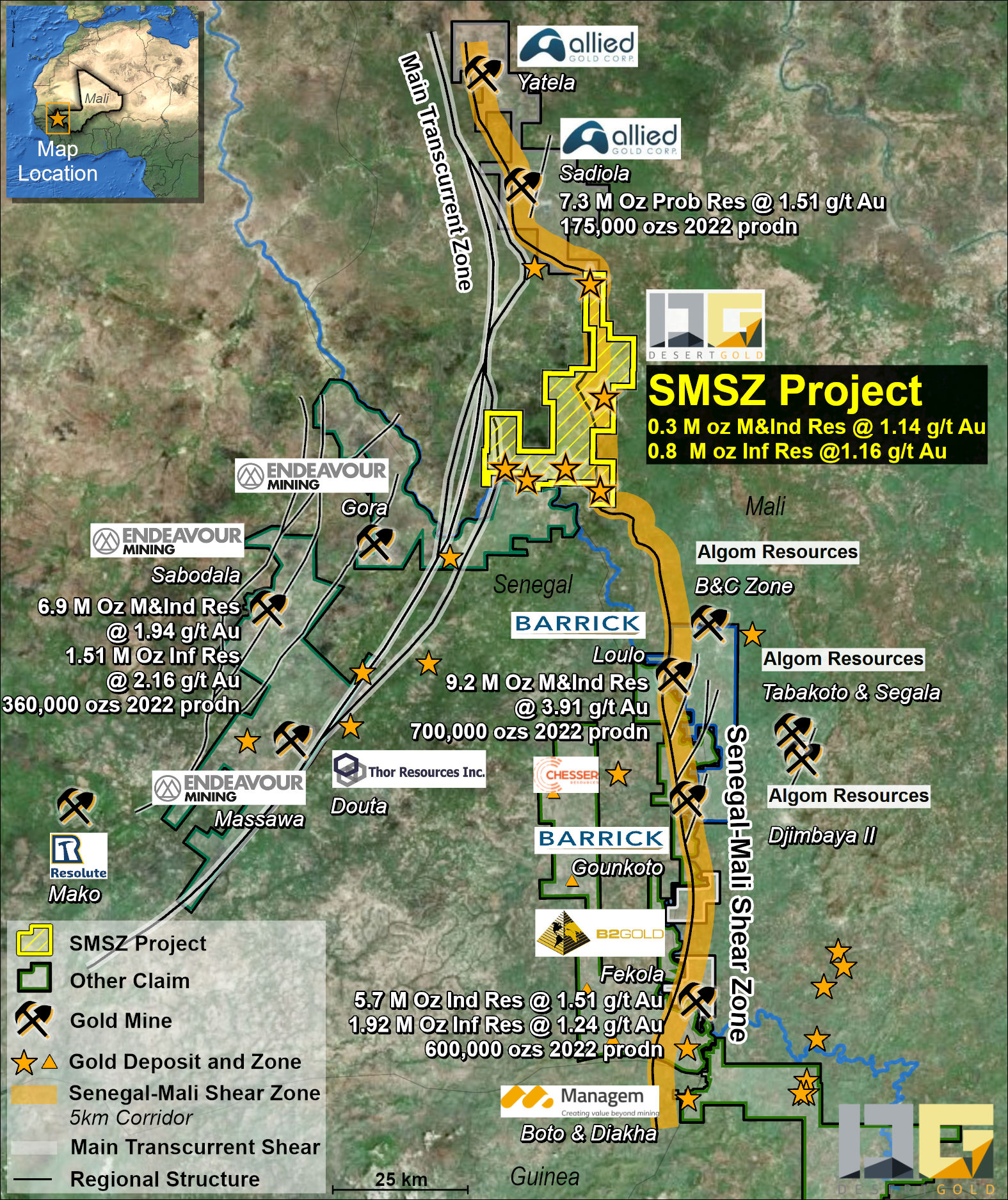

Desert Gold's flagship 440km2 SMSZ Project is located in the country of Mali and overlies a 38 km section of West Africa’s prolific Senegal Mali Shear Zone which is related to 4 tier one gold mines including B2 Gold's Fekola Mine, Barrick's Gounkoto and Loulo Mines and Allied Gold's Sadiola and Yatela Mines.

-min.jpg)